by Ashok Kumar | Jun 30, 2020 | Investments, Mutual Fund

Do you really want to create 01 Crore without any investment ?

If yes, Please ready below details.

In your life style, everyday you are expending maximum of avoidable uses, if you will save little of amount from that avoidable expense then you will 100% makes this money.

Example :

1- Case -Smoker

Normally, on my personal survey, If you have habit of smoking then you will use 01 packet of cigarette.

Suppose 01 Packet of Cigarette cost is Rs.150/–

Monthly Cost = Rs.150 x 30 = Rs.4500/-

Yearly Cost = Rs.4500 x 12= Rs.54000/-

INVEST IN SIP

Hence, This is proved that you can save Rs.54000 yearly. if you will invest same amount in SIP- Systematic Investment Plan and CAGR returns with SIP Calculator get only 15% (which is possible) then your amount would become Rs. 1,47,78,332/-

View Future value with SIP CALCULATOR and start to create your Wealth above 01 Crores free without any investment.

Invest Direct from ICICI Site New Investor – Click HERE

Invest Direct if you are Existing investor – CLICK HERE

Call us @9891423442 or visit at www.agindiaonline.com to instant investment.

![Freedom SIP -Withdraw up to 3x of your SIP installment amount]()

by Ashok Kumar | Jun 29, 2020 | Mutual Fund

| Dear Sir/ Madam |

| Invest through ICICI Prudential Freedom SIP for your preferred tenure and withdraw up to 3x of your SIP installment. Click here to know more. |

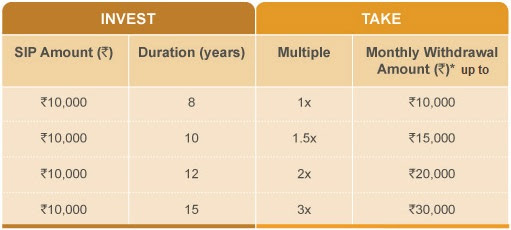

| Illustration: |

|

| For example: If you start an SIP worth Rs.10000 for a tenure of 15 years you can withdraw up to Rs. 30000* monthly after 15 years. |

| Consult Us – AMFI Reg No ARN-78099 before investing. or visit www.agindiaonline.com To start your Freedom SIP Now. |

Also Read:

1 -LIC जीवन शांति पॉलिसी में एकमुश्त निवेश कर पा सकते हैं हर महीने 4 लाख रुपये पेंशन, जीवनभर मिलता रहेगा फायदा

2 -LIC Jeevan Labh पॉलिसी में रोजाना 280 रुपये का निवेश कर, पाएं 20 लाख, जानें क्या है ये पूरा प्लान

——————————————————————————————————

by Ashok Kumar | Jun 29, 2020 | Investments, Mutual Fund

As we aware that RBI cut repo rate by 200 basis points – from six per cent to four per cent over the last one year.

“The cut in policy rates and abundant liquidity in the financial system has led to a crash in short-term interest rates and hence the mutual fund schemes investing at the short end of the yield curve are reaping low returns,”

Hence, Question is – Should you switch to ultra short-duration funds for parking your emergency corpus?

As you know that Ultra short duration fund portfolios typically have 3-6 months duration, Low duration schemes the period is 6-12 months. And liquid and overnight funds invest in securities maturing in 91 days and one day, respectively, interest rate risk is limited.

If you are ready to take risk and have specific time period to invest then our recommendations is go with Ultra Short Term Funds or Low Duration funds according to your risk profiling.

Also recommends investing in schemes backed by leading fund houses with a good track record and good quality portfolios. Additionally, we suggest you stick to larger schemes, as such funds are likely to be well-diversified and less concentrated.

You may visit our website www.agindiaonline.com for get best funds choice.

by Ashok Kumar | Jun 29, 2020 | LOAN

Kerala SSLC result 2020 | Kerala 10th exam results to be declared on June 30 @keralaresults.nic.in

How to check SSLC Result 2020 Kerala via SMS:

> SMS – KERALA10<space>REGISTRATION NUMBER

> Send the message to 56263

How to check Kerala 10th result on the Saphalam app:

> Download the application from Google Playstore

> Key in your roll numbers and other details

Get your results directly on the app

How to check on the board’s official websites

> Visit the board’s official websites keralaresults.nic.in and keralapareekshabhavan.in

> Click on the direct link for Kerala SSLC Result 2020

> Enter the roll number and other details from your hall ticket

> Hit ‘Submit’, and your Kerala Class 10 board result 2020 will appear on the screen.

> Do not forget to download and keep a print out for future reference.

> In case the website crashes due to load or is not accessible due to other reasons you can check results on manabadi.co.in, Schools9.com, sslcexam.kerala.gov.in, results.kite.kerala.gov.in, results.kerala.nic.in, and prd.kerala.gov.in.

by Ashok Kumar | Jun 29, 2020 | Investments, Shares

While the pandemic and its consequent impact on the economy, industry, and companies continue to unfold, there is merit in looking at historical data to analyse the performance of portfolios characterised by key fundamental attributes.

GROWTH (sales, EBITDA, PAT, and EPS);

RETURN (ROE, ROCE, ROOA, Delta ROE, Delta ROCE, and Delta ROOA);

MARGIN (EBITDA, EBIT, PAT, Delta EBITDA, Delta EBIT, and Delta PAT);

CASH FLOW (FCF growth and CFO & FCF yield);

FINANCIAL LEVERAGE (net debt/equity) to draw insights on how the fundamental based portfolios performed over the last 21 years (FY00 to FY20) and also how they coped with economic cycles.

The Final list of stocks is among the top 5 ranks in each market cap category that have been rated “Buy” or “Accumulate”.

Large caps: Lupin, Siemens, Info Edge, Indigo, Cipla

Mid Caps: PI Industries, IPCA Lab, Bata India, Torrent Power, Narayana Hrudayalaya

Small Caps: Strides Pharma Science, Dhanuka Agritech, V-mart Retail, Dixon Technologies, Mahindra Logistics