by Ashok Kumar | Jul 11, 2020 | Investments, Shares

OPEN ZERODHA DEMAT Account in 10 minutes- CLICK HERE

Incorporated in 2009, Rossari Biotech Ltd is a manufacturer of textiles specialty chemicals. It provides customized solutions to the apparel, animal & poultry feed, and FMCG industries by offering a diversified product portfolio. Rossari Biotech operates in 18 countries including India, Bangladesh, Vietnam, and Mauritius.

As per the F&S Report published on 30th Sept 2019, it is the largest textile specialty chemical manufacturer in India. The business of the company can be classified into three main categories which are textile specialty chemicals; animal health & nutrition products; and home, personal care & performance chemicals. The company has 1,948 different products range under these three categories.

Most of the products of the company are manufactured in-house. It has a manufacturing unit located at Silvassa, Dadra & Nagar Haveli with an installed capacity of 100,000 MTPA. The company is also setting up a manufacturing unit at Dahej in Gujarat with an installed capacity of 132,500 MTPA. Rossari Biotech also has two R&D facilities in Silvassa and Mumbai locations to focus on new product development, formulations, and cost competitiveness. It has more than 194 distributors across India and 27 distributors spread in other 17 countries.

Competitive Strengths

1. Diversified product portfolio

2. Well-known textile specialty chemical manufacturer in India

3. In-house manufacturing unit

4. Strong R&D facility

5. Pan-India distribution network

Company Promoters:

Mr. Edward Menezes and Mr. Sunil Chari are the promoters of the company.

Company Financials:

Summary of financial Information (Restated)| Particulars | For the year/period ended (₹ in Million) |

|---|

| 31-Mar-20 | 31-Mar-19 | 31-Mar-18 | 31-Mar-17 |

| Total Assets | 4,715.15 | 2489.45 | 1649.50 | 1308.94 |

| Total Revenue | 6,038.18 | 5171.24 | 3004.29 | 2605.97 |

| Profit After Tax | 652.53 | 456.83 | 254.03 | 142.85 |

Objects of the Issue:

The net proceeds of the Fresh Issue, i.e. Gross proceeds of the Fresh Issue less the Offer Expenses apportioned to the Company (“Net Proceeds”) are proposed to be utilised in the following manner:

1. Repayment/prepayment of certain indebtedness availed by the Company (including accrued interest);

2. Funding working capital requirements; and

3. General corporate purposes

Rossari Biotech IPO Details

| IPO Date | Jul 13, 2020 – Jul 15, 2020 |

| Issue Type | Book Built Issue IPO |

| Issue Size | 11,682,033 Eq Shares of ₹2

(aggregating up to ₹496.49 Cr) |

| Fresh Issue | [.] Eq Shares of ₹2

(aggregating up to ₹50.00 Cr) |

| Offer for Sale | 10,500,000 Eq Shares of ₹2

(aggregating up to ₹[.] Cr) |

| Face Value | ₹2 Per Equity Share |

| IPO Price | ₹423 to ₹425 Per Equity Share |

| Market Lot | 35 Shares |

| Min Order Quantity | 35 Shares |

| Listing At | BSE, NSE |

| P/E (x) | 33.81 |

| Market Cap (₹ Cr.) | 2207 |

Rossari Biotech IPO Tentative Date / Timetable

| Bid/Offer Opens On | Jul 13, 2020 |

| Bid/Offer Closes On | Jul 15, 2020 |

| Finalisation of Basis of Allotment | Jul 20, 2020 |

| Initiation of Refunds | Jul 21, 2020 |

| Credit of Shares to Demat Acct | Jul 22, 2020 |

| IPO Shares Listing Date | Jul 23, 2020 |

Rossari Biotech IPO Lot Size and Price (Retail)

| Application | Lots | Shares | Amount (Cut-off) |

|---|

| Minimum | 1 | 35 | ₹14,875 |

| Maximum | 13 | 455 | ₹193,375 |

Rossari Biotech IPO Promoter Holding

| Pre Issue Share Holding | 95.06% |

| Post Issue Share Holding | 73% |

Rossari Biotech IPO for NRI

Rossari Biotech Limited, the largest manufacturer of textile specialty chemicals in India is launching its IPO on 13th July 2020. The issue close date is 15th July 2020. The NRIs are allowed to subscribe to this IPO subject to certain rules and restrictions.

Rules and restrictions for NRI in Rossari Biotech IPO:

- NRIs can apply in IPO using ASBA form.

- The payment will be accepted only in Indian rupee or freely convertible foreign exchange.

- Eligible NRIs bidding on a repatriation basis should apply using blue colour Bid cum Application form meant for Non-Residents via the funds from the NRE or FCNR account.

- Eligible NRIs bidding on a non-repatriation basis should apply using white colour Bid cum Application Form meant for residents via the funds from the NRO account.

- Bids by Eligible NRIs for a bid amount of less than ₹200,000 would be considered under the Retail Category and the bid amount exceeding ₹200,000 would be considered under the Non-Institutional Category for the allocation purpose in the Offer.

Rossari Biotech IPO Investors Portion

- QIB: Not More than 50% of the offer

- NII: Not less than 15% of the offer

- Retail: Not less than 35% of the offer

by Ashok Kumar | Jul 11, 2020 | Shares

OPEN DEMAT ACCOUNT IN 10 Minutes – CLICK HERE

Incorporated in 2003, Headquartered in Mumbai Yes Bank is a private sector bank in India. It has developed as a full-service commercial bank offering banking and technology-driven product and services to fulfill the financial needs of MSME, corporate, and retail customers.

Yes Bank provides merchant banking, investment banking, and brokerage businesses through Yes Securities. The mutual fund business of the company is handled by YES Asset Management (India) Limited, a subsidiary of Yes Bank. It has a pan-India presence across 28 states and 8 Union Territories. One representative office of the bank is also established in Abu Dhabi in March 2020. As of March 31, 2020, the bank has 1,135 branches and 1,423 ATMs. Yes Bank has presence in metro, urban, semi-urban and rural locations across India.

Product and Services:

1. Investment Banking Solutions

2. Yes First Corporate Credit Card

3. Yes Prosperity Purchase Credit Card

4. Treasury and Risk Management Solutions

5. Loans

6. Transactions Banking Solutions

7. Debt Capital Markets

8. Surplus and Investments

9. Digital Banking

After Yes Bank collapse in 2019, SBI has bought around 49% stake and became the shareholder in the company.

The bank is set to launch FPO (follow-on public offer) in the middle of this July to recover from the huge bad debt and generate funds from the share sale to enhance the capital base.

Competitive Strengths

1. Public-private ownership model

2. Strong technology backbone

3. Strong focus on retail and SME advances

4. Pan India presence

Company Promoters:

Yes Bank is professionally managed and it doesn’t have any identifiable promoter.

Company Financials:

Summary of financial Information (Restated)| Particulars | For the year/period ended (₹ in Million) |

|---|

| 31-Mar-20 | 31-Mar-19 | 31-Mar-18 |

| Total Assets | 2,578,321.64 | 3,808,596.10 | 3,124,496.54 |

| Total Revenue | 103,350.56 | 144,879.93 | 130,323.20 |

| Profit After Tax | (164,325.80) | 17,092.66 | 42,332.20 |

Objects of the Issue:

The proposed utilisation of the net proceeds is for ensuring adequate capital to support growth and expansion, including enhancing the bank’s solvency and capital adequacy ratio.

Yes Bank FPO Details

| IPO Date | Jul 15, 2020 – Jul 17, 2020 |

| Issue Type | Book Built Issue FPO |

| Issue Size | [.] Eq Shares of ₹2

(aggregating up to ₹15,000.00 Cr) |

| Fresh Issue | [.] Eq Shares of ₹2

(aggregating up to ₹15,000.00 Cr) |

| Face Value | ₹2 Per Equity Share |

| IPO Price | ₹12 to ₹13 Per Equity Share |

| Employee Discount | ₹1 per share |

| Market Lot | 1000 Shares |

| Min Order Quantity | 1000 Shares |

| Listing At | BSE, NSE |

Yes Bank FPO Tentative Date / Timetable

| Bid/Offer Opens On | Jul 15, 2020 |

| Bid/Offer Closes On | Jul 17, 2020 |

| Finalisation of Basis of Allotment | Jul 22, 2020 |

| Initiation of Refunds | Jul 23, 2020 |

| Credit of Shares to Demat Acct | Jul 24, 2020 |

| IPO Shares Listing Date | Jul 27, 2020 |

Yes Bank FPO Lot Size and Price (Retail)

| Application | Lots | Shares | Amount (Cut-off) |

|---|

| Minimum | 1 | 1000 | ₹13,000 |

| Maximum | 15 | 15000 | ₹195,000 |

Note

- QIB: 50% of the net offer; NIB: 15% of the net offer; Retail: 35% of the net offer

- Employee reservation portion: ₹200 cr

- Employee discount: ₹1 per share

by Ashok Kumar | Jul 7, 2020 | Investments

Bond Investment is Safe :

Bond investment is one of best option to earn various rate of interest for long term. As we all aware that rate of interest of Bank and other schemes are going down day by day. Hence Bond investment is good option to create wealth and can generate Yield upto 11% also.

For investment in Bond DEMAT is Required. So Please open DEMAT Account on Single Click

This is instructions to OPEN DEMAT Account. For any Help please write us [email protected], [email protected] or whatsapp@9891423442

Please view my share video. This may help you to understand better.

You can view current offering Bond and there rates also. Click here to see today offers.

Some of Bonds are for your reference.

955000.00 -25000.00 (-2.55%)

07 Jul 20 | 16:00 | All Prices in

| Previous Close | 980000.00 |

|

| Open | 955000.00 |

|

| High | 955000.00 |

|

| Low | 955000.00 |

|

| VWAP | 955,000.00 |

| 52 Wk High | 984,000.00 |

|

| 52 Wk Low | 953,000.00 |

|

| Upper Price Band | 11,76,000.00(20%) |

|

| Lower Price Band | 7,84,000.00(20%) |

|

| 2W Avg Qty` | 3 |

| TTQ | 2 |

|

| Turnover(Lakh) | 19.1 |

|

| Mcap Full (Cr.) | — |

|

| Mcap FF (Cr.) | — |

|

| Face Value | 1,000,000.00 |

| Issuer Name | U P Power Corporation Ltd |

|

| YTM % at LTP | — |

|

| Next Interest Payment date / Ex Date | 20 Jul 2020/ — |

|

| Coupon % | 10.15 |

|

| Maturity Date | 20 Jan 2028 |

| Rating | IND A+(SO) |

|

| Category | Listed |

|

| Group | F |

|

| Var/ELM (%) | 10/– |

|

| Industry | – |

1107350.13 +17188.13 (+1.58%)

01 Jul 20 | 16:00 | All Prices in

| Previous Close | 1090162.00 |

|

| Open | 1107350.13 |

|

| High | 1107350.13 |

|

| Low | 1107350.13 |

|

| VWAP | 1,107,350.00 |

| 52 Wk High | 1,107,350.13 |

|

| 52 Wk Low | 1,032,152.10 |

|

| Upper Price Band | 13,28,820.15(20%) |

|

| Lower Price Band | 8,85,880.11(20%) |

|

| 2W Avg Qty` | 2 |

| TTQ | 2 |

|

| Turnover(Lakh) | 22.15 |

|

| Mcap Full (Cr.) | — |

|

| Mcap FF (Cr.) | — |

|

| Face Value | 1,000,000.00 |

| Issuer Name | State Bank Of India, |

|

| YTM % at LTP | — |

|

| Next Interest Payment date / Ex Date | –/ — |

|

| Coupon % | 9.37 |

|

| Maturity Date | 30 Dec 2099 |

| Rating | CRISIL AA+/STABLE |

|

| Category | Listed |

|

| Group | F |

|

| Var/ELM (%) | 10/– |

|

| Industry | Banks |

![How to become Mutual Fund Distributor/ Agent/ RIA in INDIA?]()

by Ashok Kumar | Jul 5, 2020 | Mutual Fund

In India there are 23 Lacs Insurance Agents,

while there are 1.5 Lacs Mutual Fund Distributors

Who is a Distributor?

An individual who proceeds for both an applicant or unit holder and mutual fund providing various advisory services and support for transaction processing, is considered as a DISTRIBUTOR

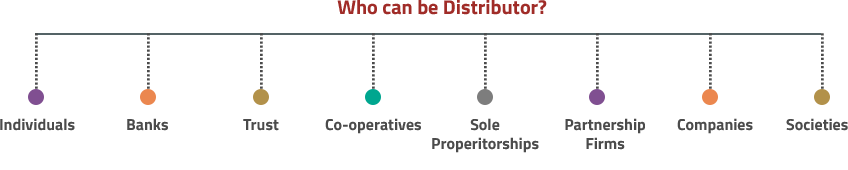

- Who can be a distributor?

>Benefits of Becoming Mutual Fund Distributors

>Benefits of Becoming Mutual Fund Distributors- You can start earning at your young age.

- You do not have to work under any boss. You are your own boss. You can work according to your own wish and in your own style.

- Flexibility in work timings will be there as unlike a job, there are no office timings.

- You can establish a good source of income for yourself by brokerage earned through mutual funds.

- You can plan for unlimited growth. The more you bring the business by selling mutual funds, the more you can earn.

- Unlike other businesses, it does not require any initial capital.

- The more AUM increases under your code, the more trail commission will you receive.

Also Read:

1 -LIC जीवन शांति पॉलिसी में एकमुश्त निवेश कर पा सकते हैं हर महीने 4 लाख रुपये पेंशन, जीवनभर मिलता रहेगा फायदा

2 -LIC Jeevan Labh पॉलिसी में रोजाना 280 रुपये का निवेश कर, पाएं 20 लाख, जानें क्या है ये पूरा प्लान

——————————————————————————————————

all those who want to get engaged in marketing and selling of Mutual Fund schemes are required to:

- Pass the NISM Certification Test known as “NISM Series V (a): Mutual Fund Distributors Certification Examination”.

- Get registered with AMFI after passing NISM Certification Test.

- Obtain a unique code-AMFI Registration Number (ARN) along with an identity card from AMFI.

- AMFI will also allot Employee Unique Identity Number (EUIN) to each intermediary along with ARN.

Join Our Become Mutual Fund Distributor

Pathshala on Telegram